We are proud to present a revolutionary service that will allow you to optimize the return on your investments and drastically reduce costs, all without having to change banks.

We are excited to introduce Sphera, one of the first Advisory robots in the world.

Leveraging Artificial Intelligence to Enhance Investment Decisions

Leggi l’Approfondimento in Italiano

Why AI in Investments

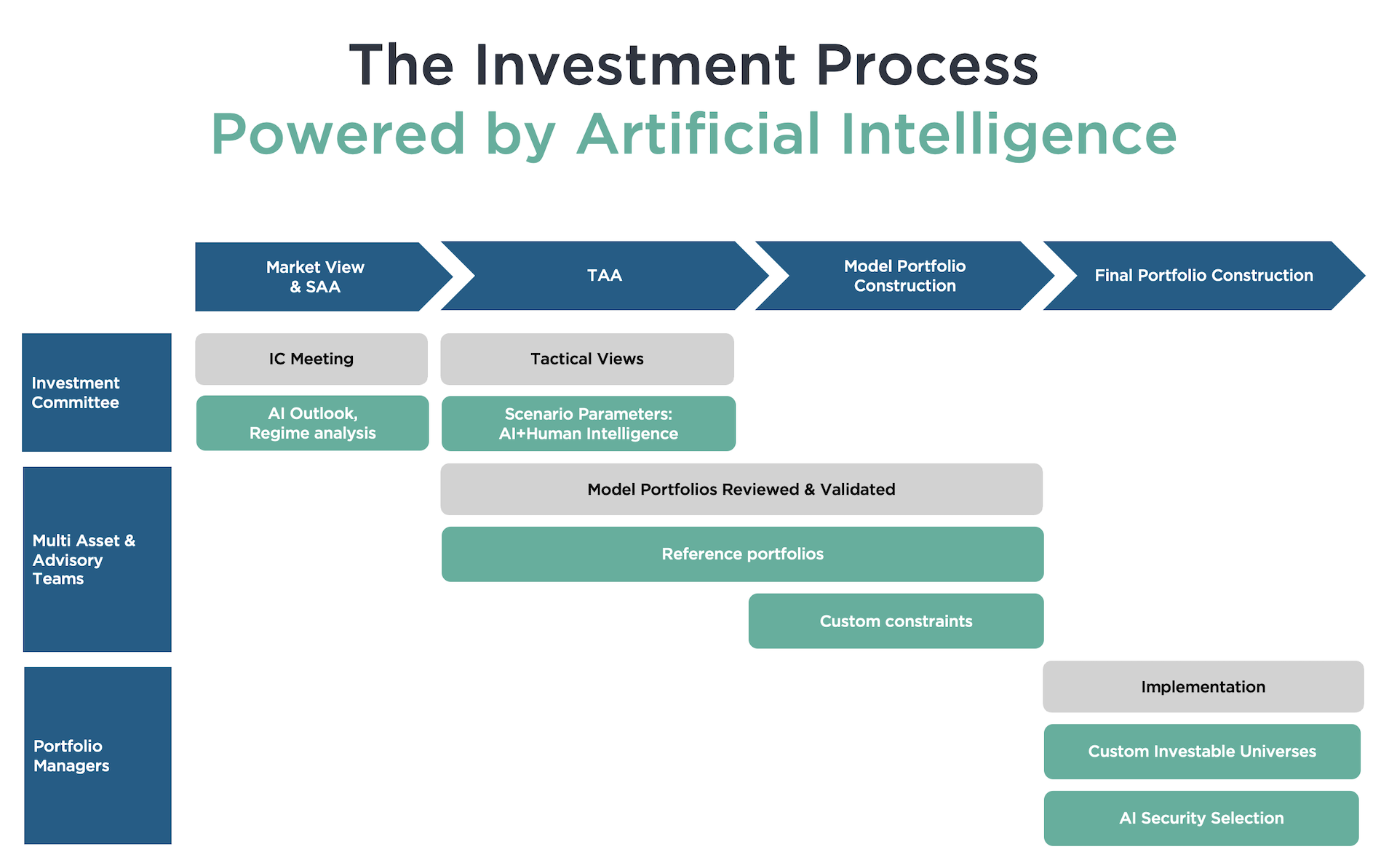

Making an investment decision is a complex and thorough process, where an abundance of information needs to be factored in. Artificial Intelligence sifts through this vast amount of information, so managers can depict the relevant data that will successfully guide their investment decisions – thus helping them build more adaptive and holistic investment views. Infinity Family Office leverages the AI of MDOTM Ltd, the global leader of AI-driven investment solutions, to navigate market complexity and enhance its investment decisions.

MDOTM Ltd’s AI technology analyses and interprets vast amounts of information, by continuously learning and adapting to the evolution of financial markets, this technology build more adaptive portfolios and obtain forward-looking investment inputs.

With this technology, portfolios are built in every aspect, leveraging AI to easily integrate constraints, complex investment objectives and custom views. MDOTM Ltd’s AI provides the relevant information so decision-makers can actively interact with it and proceed with their investment decisions. It doesn’t exclude the manager’s point of view, but empowers it with investment choices assisted by AI’s inputs for a constant monitoring of risks, a dynamic analysis of market regimes, diversification between asset classes, and much more.

Sphere: AI Platform for Investment Decision-Making

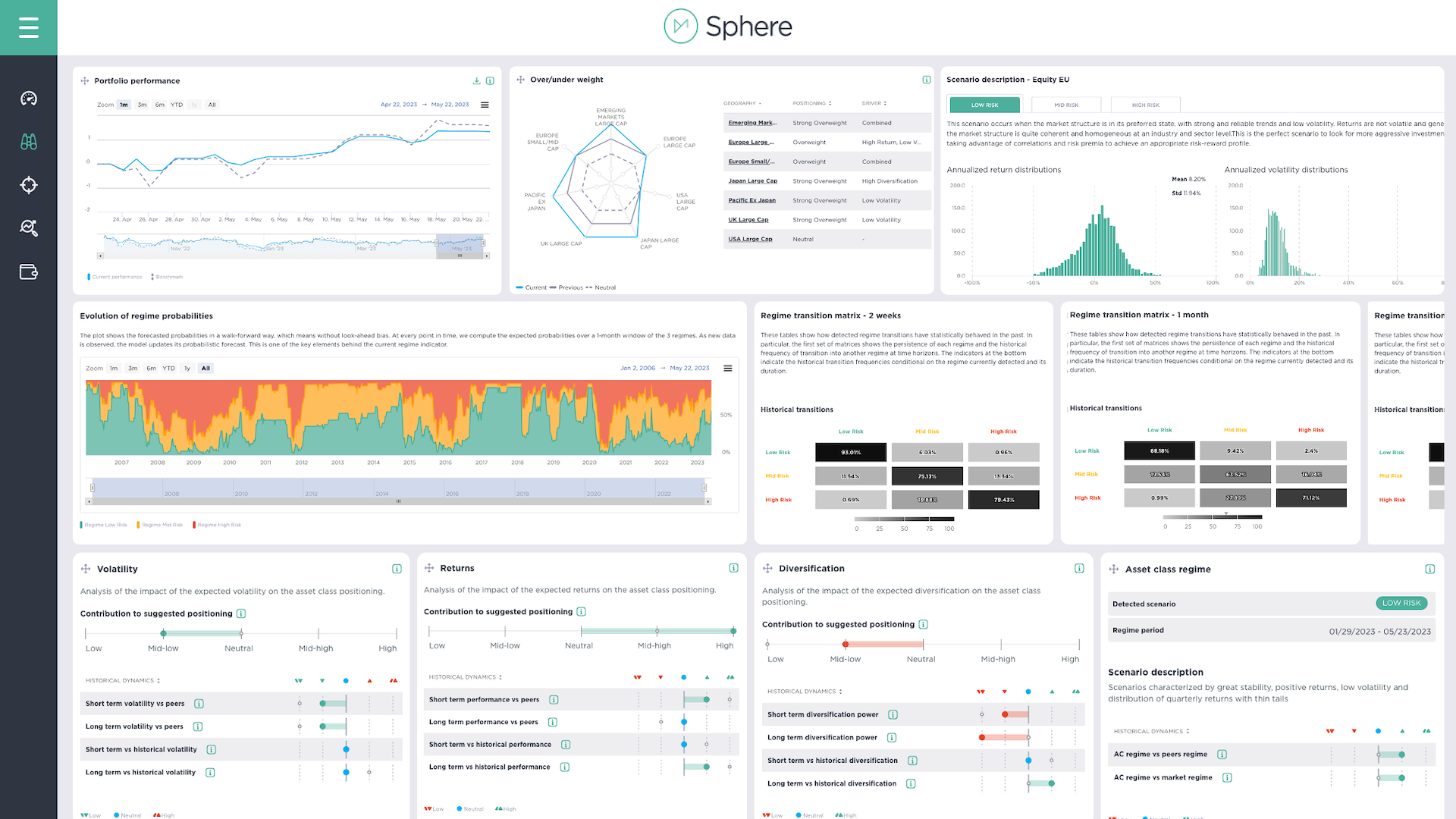

Today, increasing uncertainty and competition in financial markets forces research to find a solution that helps to see market dynamics more clearly. This is why MDOTM Ltd developed Sphere, the first no-code platform that leverages AI to provide unbiased investment inputs and manage portfolios. Sphere allows you to combine the experience of the management team with AI, to perform data analysis, build market views, and create forward-looking investment portfolios.

Sphere uses the power of cloud computing, big data, and state-of-the-art AI to turn market anomalies into profitable investment solutions. The platform helps to analyze the data, adapt to market complexity, and make objective and more informed investment decisions.

Sphere provides a wide range of features, among:

- Regime Analysis: Sphere conducts daily analysis of market regimes, assessing risk environments and market structure to guide optimal positioning and risk management.

- AI-powered Analysis: Leveraging advanced machine learning techniques such as Random Forests and Neural Networks, Sphere’s AI technology is capable of identifying patterns and deriving actionable investment insights.

- Assisted Rebalancing: With Sphere’s technology, investment professionals can define desired changes to their portfolios. Through an adaptive and automated process, Sphere’s technology creates portfolios that dynamically respond to evolving market conditions. This ensures portfolios remain aligned with investment goals and optimally positioned in the ever-changing market landscape.

Pioneer of AI in Investments

Since 2015, MDOTM has been pioneering AI-Driven Investments Strategies for Financial Institutions. The company’s award-winning proprietary AI technology exploits changes in market inertia and risk premia to provide robust and reliable investment portfolios. MDOTM is the only European fintech selected for Google’s Silicon Valley acceleration program and became the first AI-driven advisor to sign the UN-supported Principles for Responsible Investment (UNPRI). Recently, MDOTM was awarded as one of the top 100 Wealthtech and AI Fintech companies in the world.

MDOTM’s Core: Science-Rooted Investment Decisions

With a team of over 100 data scientists, engineers, and finance experts that monitors the technology every day, MDOTM Ltd.’s proprietary AI engine is shaped, tailored and trained according to each client’s specific needs and requirements. MDOTM Ltd has built strong ties with industry and academia, resulting in an international network of universities and academic advisors called the MDOTM LAB.

Over 20 academic professors and 30 PhD and Master’s students participate in its activities, producing cutting-edge research at the intersection between machine learning, portfolio management, behavioural finance, ESG, AI ethics and responsibility. MDOTM Ltd invests 70% of its budget in research, allowing them to keep up with the latest developments and breakthroughs in AI in finance.